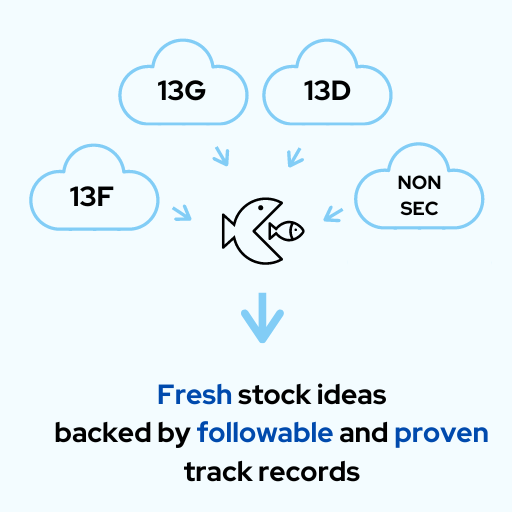

AI-driven stock picks

fueled by proxy smarts

Proxy smarts means the AI does not look directly at stocks, but at stock pickers. We use AI to analyze SEC filings (13F, 13G, 13D) and identify institutional investors with consistent, successful investment patterns in recent filings — a signal they hold non-public insights, like insider knowledge, that AI alone can’t access. Our approach leverages AI to pinpoint those with this hidden edge, delivering stock portfolios that are followable and resilient to delays in SEC data. Data mining is made possible through the SEC’s commitment to transparency 💜.

Insider Investors

Add-on portfolios built on SEC filings from industry insider institutional investors. Data mining is made possible through the SEC’s commitment to transparency ❤️.

REIT Industry Insiders Add-On

How to use

Choose one of our portfolio ideas as a guide, or integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied

CBRE and Cohen & Steers

Suggested ETFs to add onto

VNQ (Vanguard Real Estate ETF), SCHH (Schwab U.S. REIT ETF), IYR (iShares U.S. Real Estate ETF), XLRE (Real Estate Select Sector SPDR Fund)

This is the consensus portfolio of two prominent institutional investors with extensive experience and insider knowledge in the real estate industry: CBRE and Cohen & Steers.

1. CBRE is the global leader in real estate services, providing a wide range of services including investment management, property management, and leasing. Their deep insider knowledge, coupled with their comprehensive understanding of the real estate market, allows them to identify attractive REITs with strong growth potential and solid fundamentals.

2. Cohen & Steers is a leading global investment manager specializing in real assets, with a focus on real estate securities. Their experienced team of investment professionals employs a rigorous research-driven process to identify high-quality REITs with sustainable income and long-term growth potential.

This portfolio includes only Real Estate Investment Trusts and excludes other types of real estate investments they may have. REITs are known for their potential to generate steady income and offer capital appreciation.

Utilities Industry Insiders Add-On

How to use

Choose one of our portfolio ideas as a guide, or integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied

Bluescape Energy Partners, Reaves Asset Management, + 6 institutional investors.

Suggested ETFs to add onto

XLU (Utilities Select Sector SPDR Fund), VPU (Vanguard Utilities ETF), IDU (iShares U.S. Utilities ETF).

This Utilities portfolio is the consensus of eight institutional investors, each one with a proven track record in the utilities industry. We search for experts and insiders who specialize in identifying promising stocks in the utilities sector, offering exposure to companies that provide essential services such as electricity, gas, water, telecommunications, and renewable energy. We disclose two of these investors:

1. Bluescape Energy Partners, a private investment firm focused on the North American energy sector, including utilities. They emphasize capital preservation and defensive positioning. Main focus: strong cash flows, long term growth prospects, unrecognized value creation opportunities.

2. Reaves Asset Management, a highly specialized investment management firm with a focus on essential service companies. Their team consists of professionals dedicated to understanding the complexities of the utilities sector, including market dynamics and regulations. Investment philosophy: companies with limited competition, high regulatory scrutiny, consistent cash flow generation and profitable even in down economic cycles.

By exploring the stock ideas presented in this portfolio, you can uncover a diversified range of opportunities in the utilities industry, carefully selected based on a broad spectrum of specialists and insiders.

These stocks are known for their historical stability, reliable income, and strong dividend yields, making them an attractive addition to any investment portfolio.

Smart Money’s Portfolio Add-Ons

Add-ons built on SEC filings from top institutional investors in specific themes and allocation strategies. Data mining is made possible through the SEC’s commitment to transparency ❤️.

Value Investors “Old School” Add-On

How to use

Integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Buffett’s Berkshire Hathaway, Dalio’s Bridgewater, Marks’ Oaktree Capital, and Ackman’s Pershing Square.

These are the current top 5 stock from the combined portfolios of four of the most successful investors in History:

1. Warren Buffett, Chairman of Berkshire Hathaway;

2. Ray Dalio, Founder of Bridgewater Associates;

3. Bill Ackman, Founder of Pershing Square and

4. Howard Marks, Cofounder and Vice President of Oaktree Capital.

These investors have a reputation for investing in established companies with solid fundamentals, steady growth potential, and reliable dividend yields.

Growth Leaders “Future Value” Add-On

How to use

Choose one of our portfolio ideas as a guide, or integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Baillie Gifford, Crosslink Capital + 2 institutional investors.

The Future Value portfolio is designed to provide investors with exposure to high-growth companies, selected based on the consensus of four institutional investors, including Baillie Gifford and Crosslink Capital. While the portfolio may include some non-growth stocks, its primary focus is on companies with strong growth potential.

1. Baillie Gifford is a leading independent investment management firm with a long history of identifying high-growth companies across various sectors.

2. Crosslink Capital is a venture capital and growth equity firm with a long history of investing in private and public technology companies. Their deep industry knowledge and extensive network of relationships help them identify and support high-growth businesses across various sectors.

By considering the ideas in the Future Value portfolio, you can gain insights into a diverse range of high-growth companies, handpicked by experts. It’s important to note that growth stocks are conceptually opposed to value stocks: while growth stocks are characterized by the expectation of significant future value, value stocks are primarily focused on the present value of the company’s assets and earnings. This portfolio offers a selection of stocks that emphasize potential future growth, providing an attractive opportunity for investors seeking exposure to this investment style.

Consumer Staples “Stable Staples” Add-On

How to use

Integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Coho Partners, Lindsell Train + 14 institutional investors.

For those seeking safe ways of investing in stocks, we present a Consumer Staples portfolio, with well-known and stable companies, that were selected by sector-specialized institutional investors, who spend millions in research and analysis.

Spanning sectors from food and beverage manufacturing to household and grocery retail, consumer staples taps into businesses whose products or services are always in demand. The inherent stability in these sectors underpins the defensiveness of the portfolio, often outperforming others when the market is under stress.

As highlighted by Warren Buffett, the consumer staple sector is attractive due to its simplicity and indispensable nature. The products and services of these companies are easy to understand, with demand unaffected by AI advancements.

As a snapshot of our approach, we disclose two of the sixteen investors whose portfolios are fed into our algorithm.

Coho Partners. An investment firm focused on demand-defensive companies for more than two decades, aiming to significantly outperform in down markets and compete in all but the strongest up markets.

The second investor is Lindsell Train. A firm focused on UK and US equity of consumer branded goods, pursuing characteristics like heritage, predictable earnings through pricing power or intellectual property, low capital intensity and sustainably high returns on capital.

We seek to harness the power of brand equity, customer loyalty, and the stability that comes from commanding a significant share of the market. This is the case of companies such as Coca-cola, Procter and Gamble, and Church and Dwight.

This consumer staples portfolio presents a compelling proposition for investors seeking a low-risk strategy with strong long-term returns.

Small and Microcap “Medley” Add-On

How to use

Integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Meritech Capital Partners, Wynnefield Capital, Inc. + 5 institutional investors.

Suggested base ETFs: IWM (iShares Russell 2000 ETF), IJR (iShares Core S&P Small-Cap ETF), IWC (iShares Micro-Cap ETF)

The Small and Microcap Add-On presents a collection of stock ideas derived from the combined portfolio of seven institutional investors with expertise in identifying promising microcap companies across various sectors. We disclose two of these investors:

1. Meritech Capital, a leading growth equity firm that specializes in rapidly-growing technology companies. With their extensive experience and deep industry knowledge, Meritech Capital has a consistent track record of identifying and supporting high-potential microcap companies on their journey to becoming major tech players. They have successfully identified companies such as Salesforce, Snowflake, Tableau and Meta (Facebook) during their late-stage startup phases.

2. Wynnefield Capital, as described by themselves, “a value investor, specializing in U.S. small cap situations that have a company or industry-specific catalyst(s). Surfacing of these catalysts unlocks existing, but previously unrecognized value for shareholders. (…) We seek out under-followed, unrecognized and undervalued companies that fit our parameters, which include minimal balance sheet risk and potential for micro or macro change.”

By exploring the ideas in our ‘Microcap Medley’ portfolio, you can gain insights into a wide range of companies, blending value and growth stocks with a market capitalization under $2 billion and prior to widespread public recognition.

Global Markets ex-US “Explorer” ADR Add-On

How to use

Integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Includes EM and Developed Ex-US

This portfolio is a selection of non-U.S. companies traded on U.S. exchanges in the form of American Depository Receipts (ADRs).

These stocks are identified through the consensus of six institutional investors, carefully selected for their expertise. Some of them have a strong focus on global equities, while others are specialized in emerging market companies, and one has extensive knowledge of Asian markets.

By combining the collective wisdom of these brilliant and diligent minds, we can deliver a portfolio that is both less obvious and able to capture some best-in-class opportunities from around the world, making it an ideal complement to a portfolio of American companies.

If you want ADRs/Global investment ideas, also check the China Prosperity Path portfolio.

Mining and Metals “Masters” Add-On

How to use

Integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Undisclosed institutional investors with a strong focus on metal commodities.

Suggested base ETFs: XME (SPDR S&P Metals & Mining ETF), PICK (iShares MSCI Global Metals & Mining Producers ETF), GDX (VanEck Gold Miners ETF)

Investing in the mining sector may be extremely challenging. Many companies are in the exploration or pre-operational phase, which entails frequent capital raises, with a recurrent dilution of shareholders’ stakes. Not to mention the risk of poorly managed companies with a low probability of ever producing anything. Therefore, it is crucial to rely on the expertise of mining professionals for informed decision-making, allowing an asymmetrical exposure to a thesis with astonishing upside potential.

This ‘Mining Masters’ portfolio is designed for investors seeking exposure to the dynamic world of mining and metal companies. It is constructed from the blend of two undisclosed institutional investors with a strong focus on metal commodities, comprising teams of geologists, lawyers and engineers with decades of experience in this market. Their expertise spans various commodities, including precious metals such as gold and silver, as well base metals like iron, copper and zinc.

By investing in this portfolio, you gain access to a carefully selected range of companies, from well-established industry leaders to emerging players with high growth potential. These stocks aim to capitalize on global trends, such as the surging demand for metals used in electric vehicles and other green technologies, as well a

US Industrial SmallCaps “Proudly Made in USA” Add-On

How to use

Integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Fuller & Thaler Asset Management + 3 institutional investors

Suggested base ETFs: XLI (Industrial Select Sector SPDR Fund), VIS (Vanguard Industrials ETF), IYJ (iShares U.S. Industrials ETF)

Introducing our 100% American SmallCaps Industrial stocks portfolio, which combines the expertise of four American institutional investors, each one identified by us for their ability to find promising small-cap industrial companies with strong growth potential.

One of these institutional investors is the renowned firm Fuller & Thaler Asset Management, which has a proven track record of identifying small-caps within a behaviorial driven environment. With a team of experienced investors, including Nobel Prize winner Richard Thaler, this firm has been recognized for their innovative research and ability to generate significant returns in this space.

We opt to keep the other three sources of this portfolio undisclosed. All of them have in common, aside from their consistent results across various investing windows, a full commitment to a bottom-up, fundamental research approach for small companies with a long-term focus.

By investing in this portfolio’s ideas, you gain access to a diversified range of local industrial stocks, positioning yourself to benefit from the U.S. government’s policies aimed at supporting local factories.

China “Properity Path” ADR Add-On

How to use

Integrate it into your current portfolio by applying your preferred weight ratio.

Recent Performance Chart (click here)

Performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach accounts for the inherent delay, yet still delivers strong results due to the long-term strategies employed by the institutional investors being followed. The inception of each chart (starting date) varies depending on the inception dates of the funds being tracked.

Portfolio and Investors Summary

SEC filings copied: Snow Lak Camital, Keywise Capital Management + 2

Suggested base ETFs: MCHI (iShares MSCI China ETF)

China’s economy is expected to surpass the United States’ within the next few decades, highlighting the immense growth potential of Chinese companies. However, investing in these enterprises can be challenging due to the unique characteristics of the local market, such as stringent government regulations, lack of transparency, and cultural differences.

This portfolio is a selection of American Depository Receipts (ADRs) primarily from Chinese companies, curated by four Hong Kong-based institutional investors with in-depth knowledge and expertise in the Chinese market. Renowned for their ability to navigate the intricate landscape of investing in Chinese companies, these experts have a proven track record of success in multiple time frames.

Despite having the majority of their investments in China, they also hold a substantial amount of investments in U.S. securities, which obligates them to report their holdings to the SEC.

These investment ideas provide a diversified approach to gaining exposure to the Chinese market, covering various sectors and market caps, and leveraging the insights of these Hong Kong specialists who have a deep understanding of the local market idiosyncrasies.

Add-ons are crafted to ensure followability and consistency

5+ Years of Expertise

With over five years of experience, Smart Money Research, the company behind diyETF.com, is dedicated to identifying the best insights from smart money investing.

Followability

We focus on portfolios that perform well even with delayed SEC data, which indicates a medium to long-term stock-picking strategy. These portfolios are what we call “followable.”

Alpha with Consistency

Our add-ons are based on in-depth monitoring of SEC filings (13F, 13G, 13D) to identify the most profitable and consistent institutional investors across stocks, ETFs, ADRs, and specific sectors.

Long Time Frames

Strategies with a long-term focus make any delay in SEC data negligible, ensuring consistency in results.

First Movers and Repeated Successes

We track institutional investors with a record of anticipating market changes and consistently adjusting their portfolios in advance. Their success is based on skill, not survivorship bias.

Synergy

Our research builds on the consensus among top institutional investors, leveraging the synergy from overlapping picks to enhance portfolio strength.

We monitor the Securities and Exchange Commission mandatory filings (13F, 13G, 13D), Investor Relations Channels, and other data sources:

- 1 – identifying the most profitable and consistent institutional investors in each stock/ETF/ADR sector/bias;

- 2 – checking if their copied portfolios perform well even with delayed SEC data (that means they are usually picking stocks for the medium or long term). We call these portfolios “followable”;

- 3 – searching for group synergy in the consensus between candidate institutional investors;

- 4 – going after fresher portfolios than those disclosed by the SEC’s 13F, cross-referencing data from various sources.

Start building a smarter portfolio

FAQ

Do the performance charts account for SEC data delays?

Yes, performance is calculated by rebalancing the portfolio after SEC filings are disclosed. This approach inherently accounts for the delay in SEC data, while still delivering strong results due to the long-term strategies employed by the institutional investors being tracked.

Are the recommended portfolios subject to the same delay as data provided by the SEC?

Typically, they are, but there can be exceptions.

Forms 13D and 13G from the Securities and Exchange Commission (SEC) can provide valuable information about stock ownership in SEC-registered companies. Institutional investors with stock ownership between 5% and 20% can choose to file either Form 13D or Form 13G, depending on their intentions regarding the company.

Form 13D is required of anyone or group that acquires a stock ownership that reaches or exceeds 5% of the outstanding shares of an SEC-registered company. Form 13G is required of anyone or group that acquires between 5% and 20% of the outstanding shares of an SEC-registered company and has no intention of influencing control of the company.

Both forms provide valuable information about the size and nature of the stock ownership, as well as the owner’s intentions regarding the company. This information can be used to update portfolios.

Where can I find monthly performance and historical records of portfolios?

The videos available on SmartMoneyResearch.com dynamically display the complete recommendation history and corresponding performance. Moreover, users can explore in-depth all the stocks mentioned in each new quarter by browsing the website.

Why is Smart Money Research better than using the SEC website directly?

At Smart Money Research, we do the hard work for you by carefully handpicking the most appropriate hedge funds to follow.

Our in-depth research allows us to identify expert managers in each investment area, while eliminating those with frequently changing positions or a history of closing underperforming funds (survivorship bias).

Finally, we also seek synergy between the different chosen funds, where the successes of various managers add up and the mistakes cancel each other out. Thus we can deliver stock portfolios with great added value to our clients, which are not available in simple consultations to the raw SEC data.

What inspired the creation of Smart Money Research?

We realized that there is enormous value in the data that fund managers are required to provide to the SEC.

Although the purpose of this disclosure is to provide greater transparency for transactions, the general public can greatly benefit from investment ideas curated by experts who heavily dedicate themselves to identifying the best opportunities.

However, we know that the sole use of this information can lead to adverse outcomes, thus requiring data treatment work to choose which 13F forms are ideal to copy, and which filters are necessary to remove noise and potentially harmful information for investors.

Is the information provided by Smart Money Research subject to verification?

Yes, all information disclosed on our website undergoes rigorous verification before being made available to our users. This is important to ensure that our investment recommendations are based on accurate and reliable data, enhancing the security and efficacy of our clients’ investment decisions.

Are the recommended portfolios easy to understand, even for individuals with no investment experience?

Yes. Everyone can benefit. From beginners to set up their first stock portfolio, to experienced investors who want to compare their strategies with smart money approaches.

Are the selected institutional investors susceptible to survivorship bias?

Survivorship bias is the tendency to focus on the investment performance of active funds that have survived until the present time, while ignoring the funds that have failed and disappeared from the market. This can lead to an overestimation of the performance of the surviving funds, as they may represent a selected group of successful funds that have managed to survive through skill or luck.

To avoid survivorship bias in the process of copying portfolios, we can use a comprehensive dataset that includes both active and defunct funds. This will enable us to assess the historical performance of all funds, including those that have failed, and to avoid selecting only the successful funds.

In addition to using a comprehensive dataset that includes both active and defunct funds, there are additional techniques we can employ to avoid survivorship bias when copying portfolios. For example, we can consider longer periods of time when evaluating fund performance, test the fund’s performance in multiple windows throughout this period, verify the fund’s resilience to crises, and use statistical techniques to identify cases of pure luck.

By using these techniques, we can gain a more complete and accurate picture of the historical performance of each fund, and avoid relying solely on the performance of a select group of successful funds that may have been subject to survivorship bias. This can help us to create a more robust and diversified portfolio that is better positioned to achieve our investment objectives.

Is it fully functional on smartphones?

Yes, the website is 100% usable with all its functionalities on mobile. As with many applications, the user experience on desktops may offer a slight advantage due to the ability to display more information simultaneously.

At Smart Money Research, the team behind diyETF.com, we are a multidisciplinary group with expertise in engineering, computer science, physics, and investment analysis. One of our core strengths is identifying top-performing investors across various investment themes, focusing on those with public portfolios.

Since 2020, we have employed proprietary research to pinpoint investors who consistently excel across different time frames and market conditions, carefully avoiding survivorship bias. Through a series of rigorous processes, we combine each investor’s portfolio under strict guidelines, aiming to optimize performance while minimizing volatility.

Smart Money Research

Des. Ermelino de Leao 15 . Cj. 42. Curitiba · Brazil