Put Wall Street’s best minds and deep pockets to work for youMirror the highly profitable stock picks of the market masters, no stock analysis required — it’s that simple.

The Power of Consensus: Direct Access to Wall Street’s Most Coveted Stock Selections

Explore our services and profit like top-tier investments. Only $8/mo for each portfolio.

Stocks

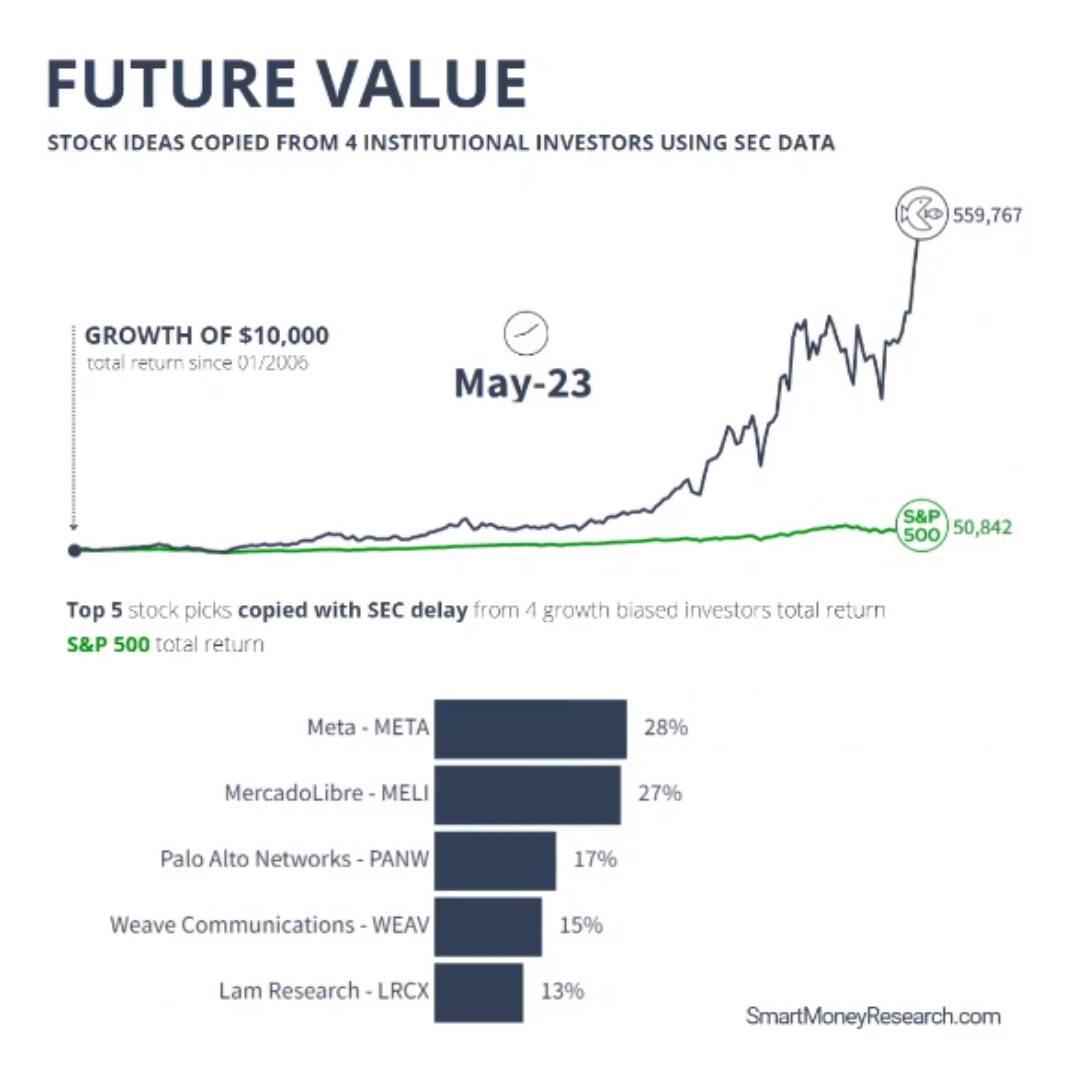

Future Value

5597% x 508% (S&P500)

since 01/2006

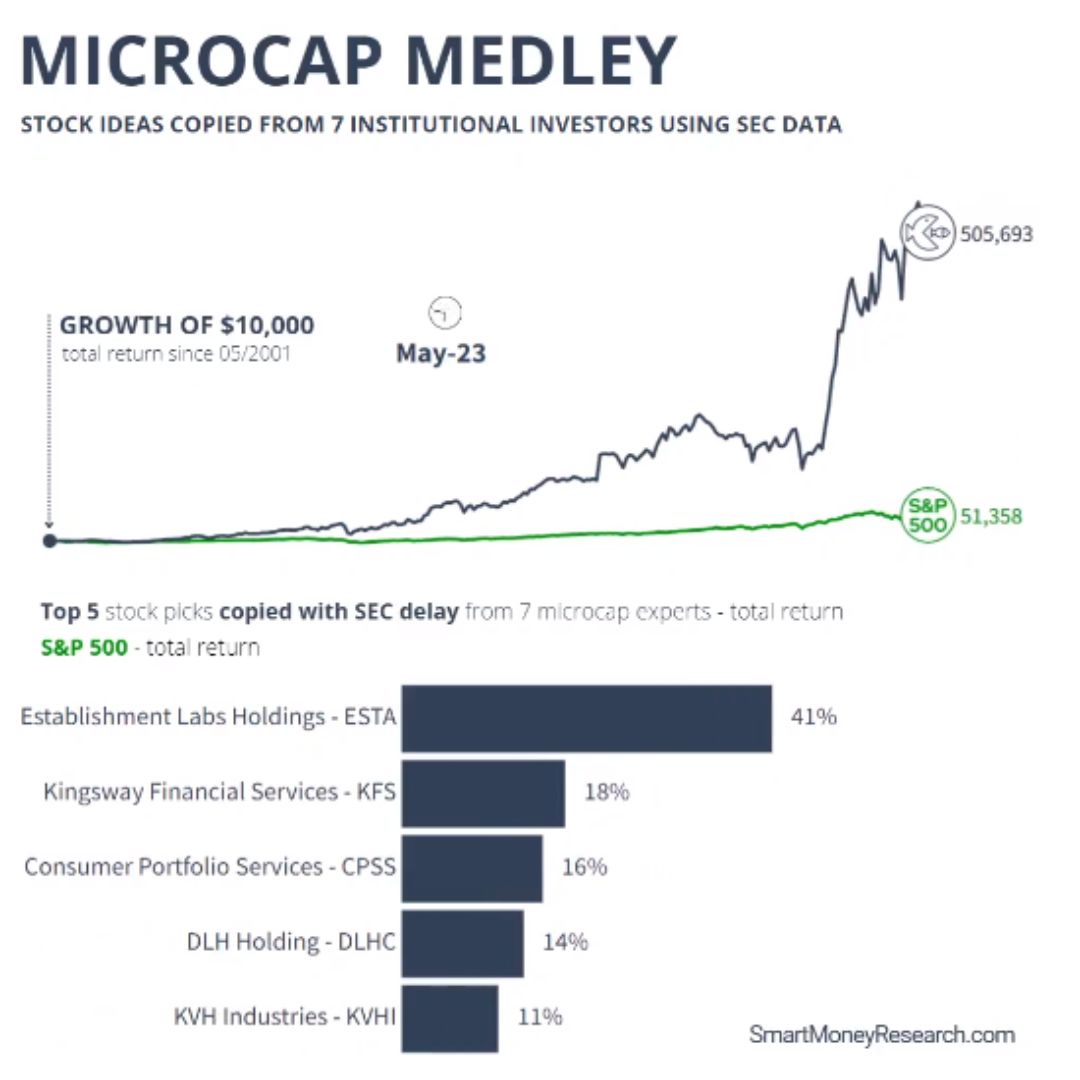

Microcap Medley

5057% x 513% (S&P500)

since 05/2001

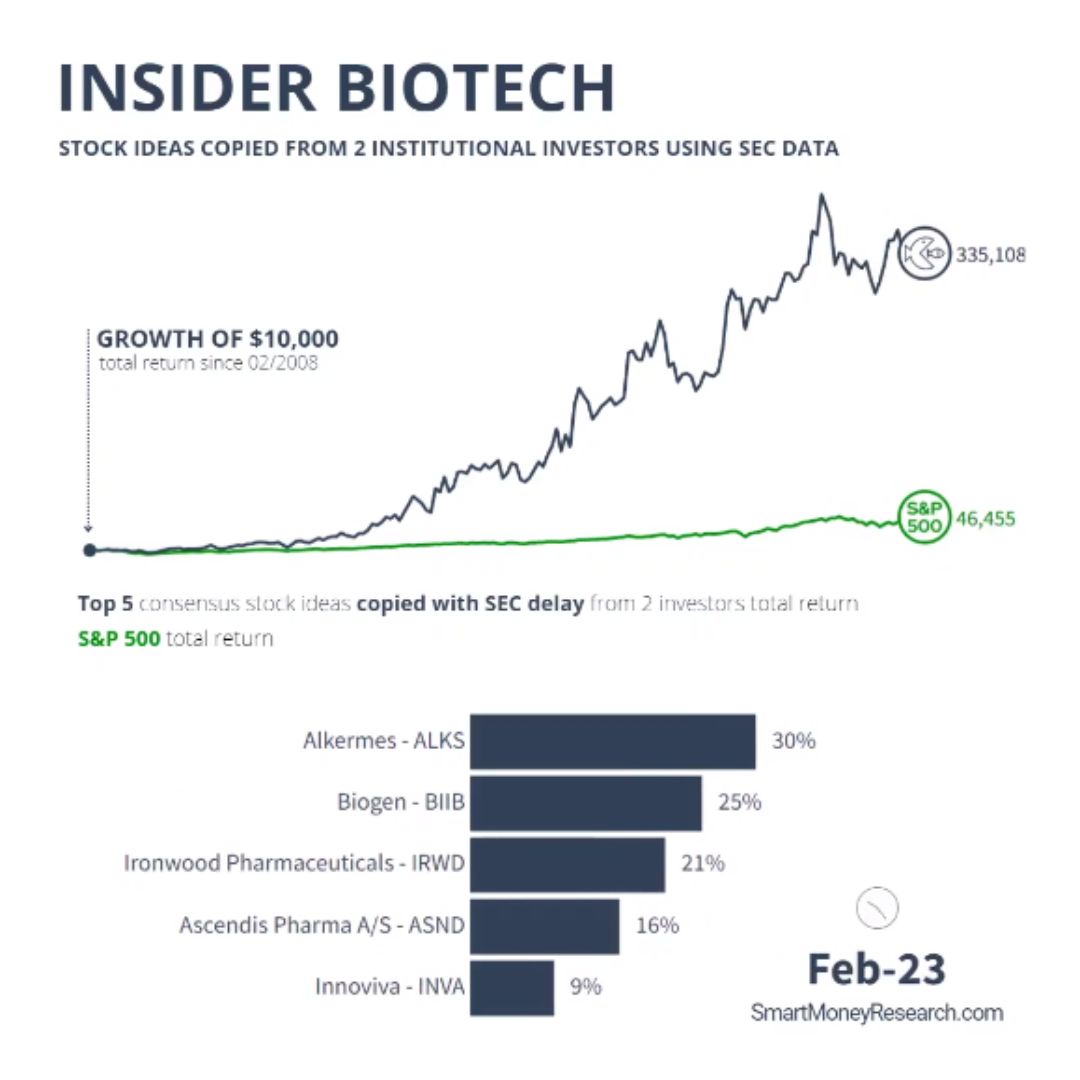

Insider Biotech

3351% x 465% (S&P500)

since 02/2008

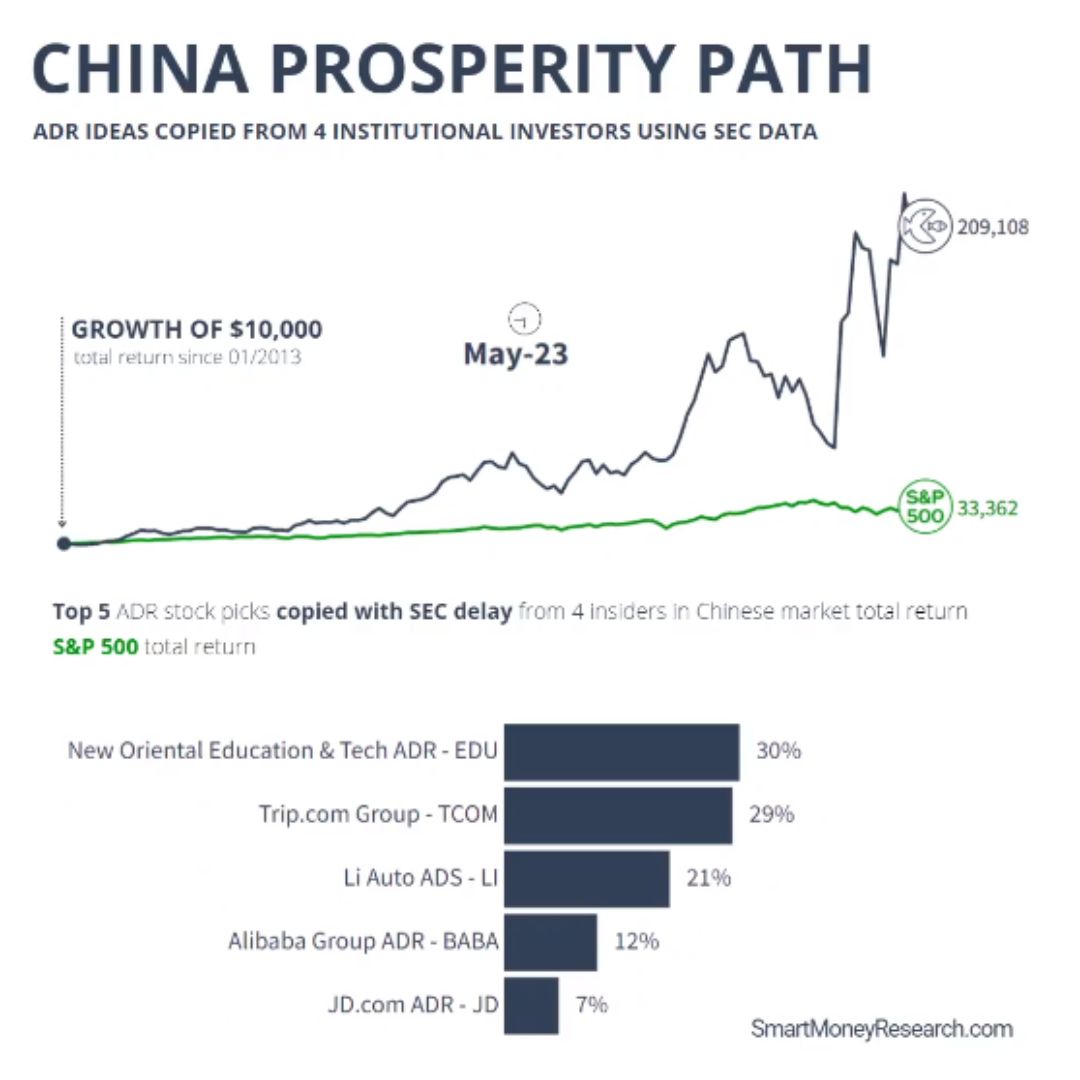

China Prosperity Path

2091% x 334% (S&P500)

since 01/2013

Proudly Made in USA

2680% x 538% (S&P500)

since 03/2001

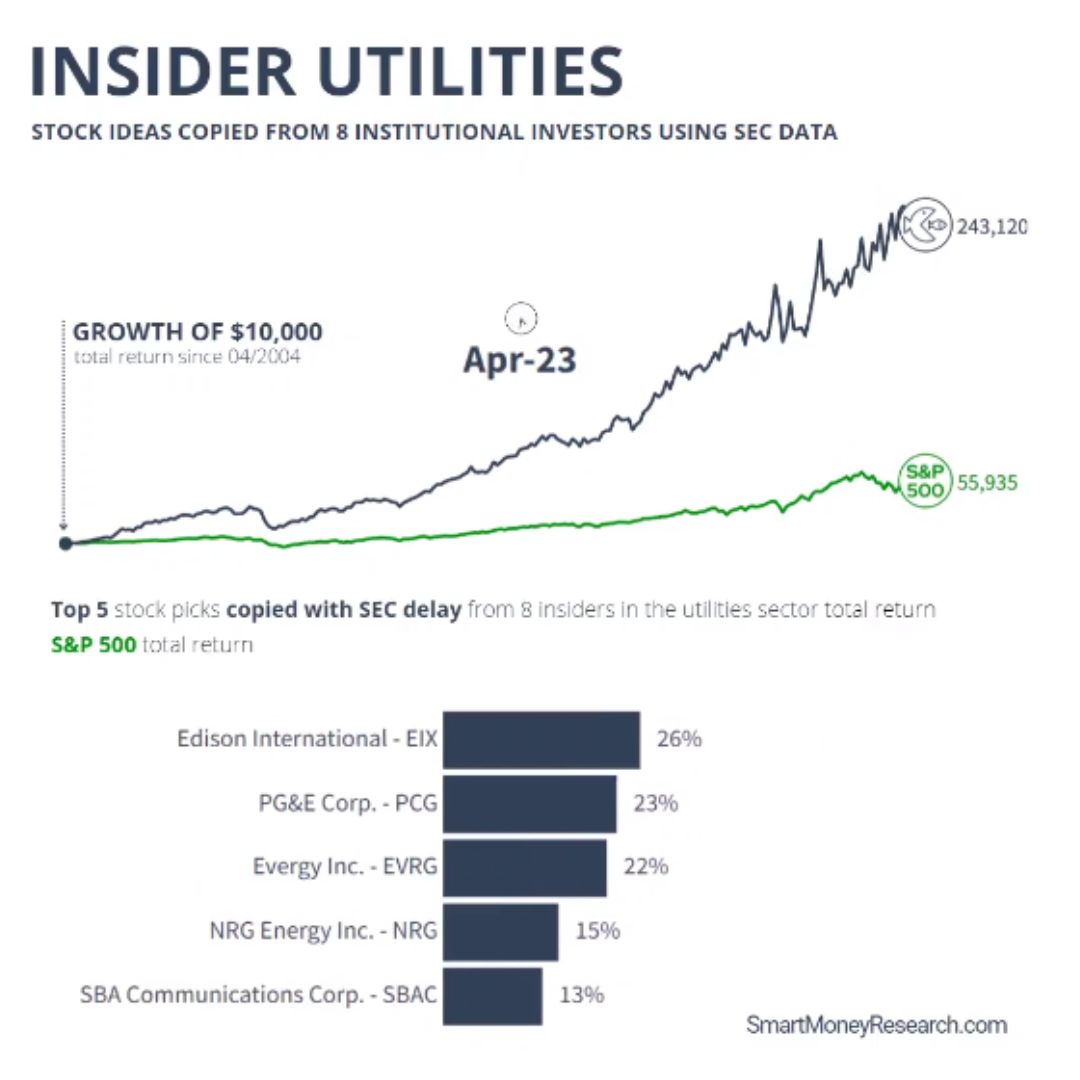

Insider Utilities

2431% x 559% (S&P500)

since 04/2004

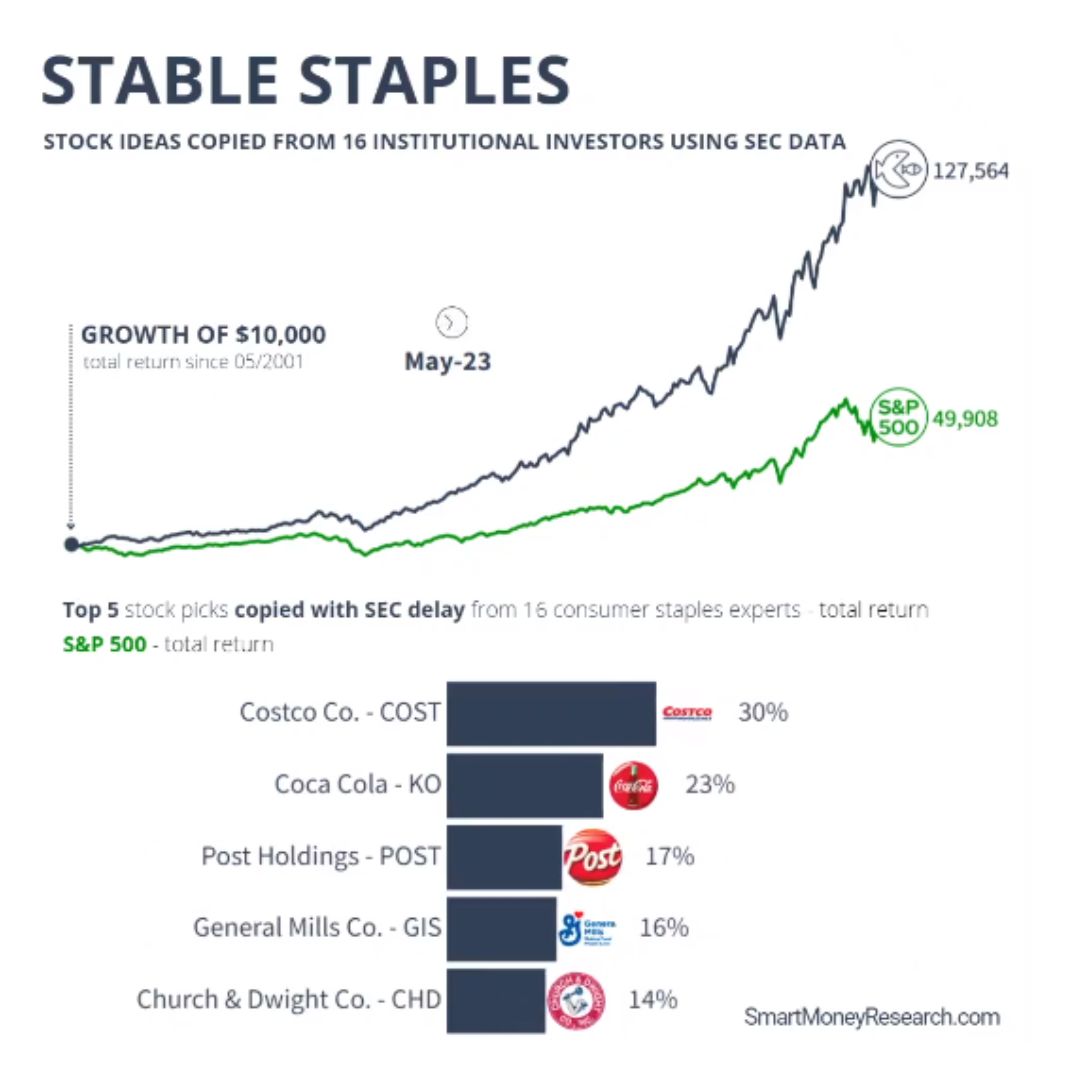

Stable Staples

1276% x 499% (S&P500)

since 05/2001

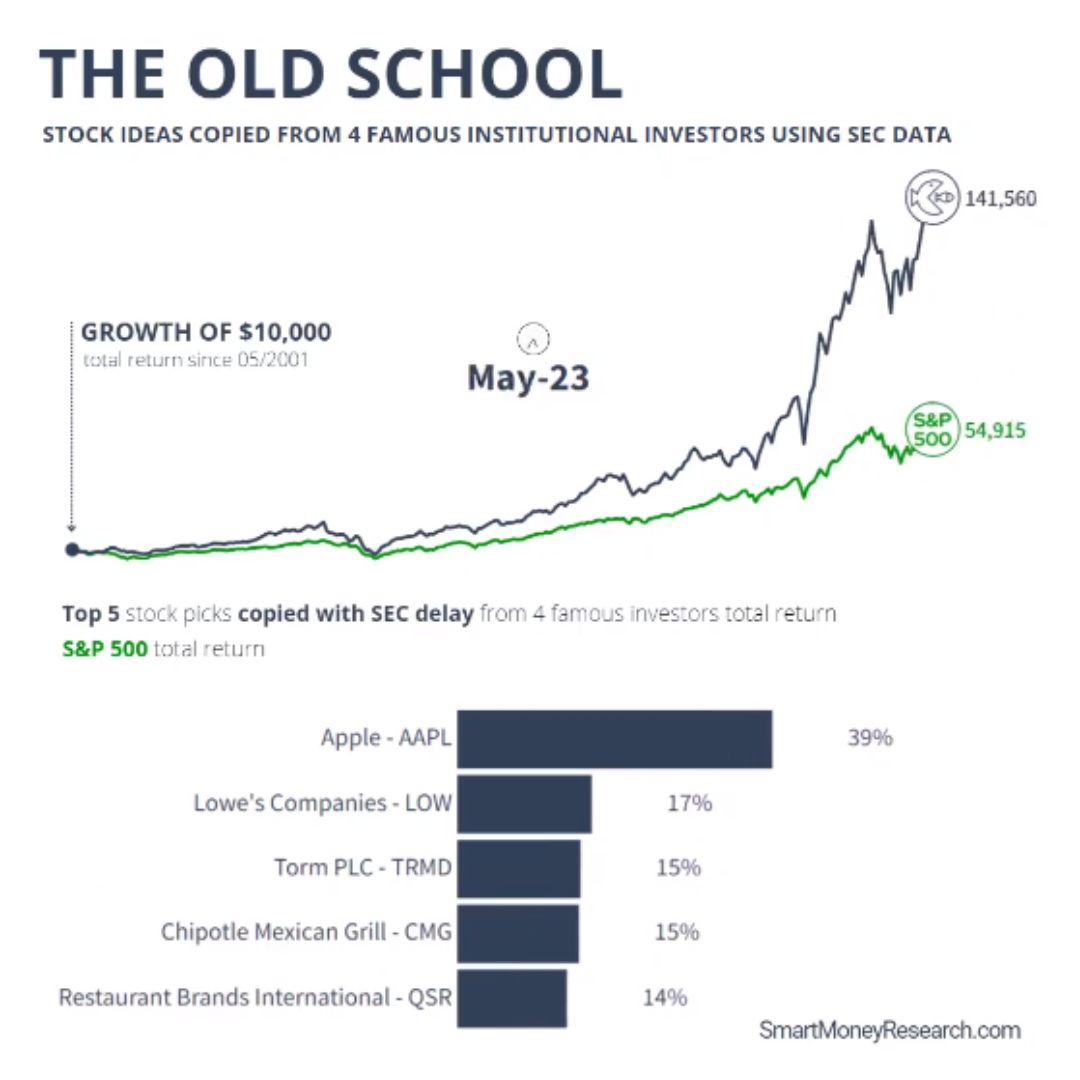

The Old School

1416% x 549% (S&P500)

since 05/2001

Mining Masters

1218% x 557% (S&P500)

since 07/2009

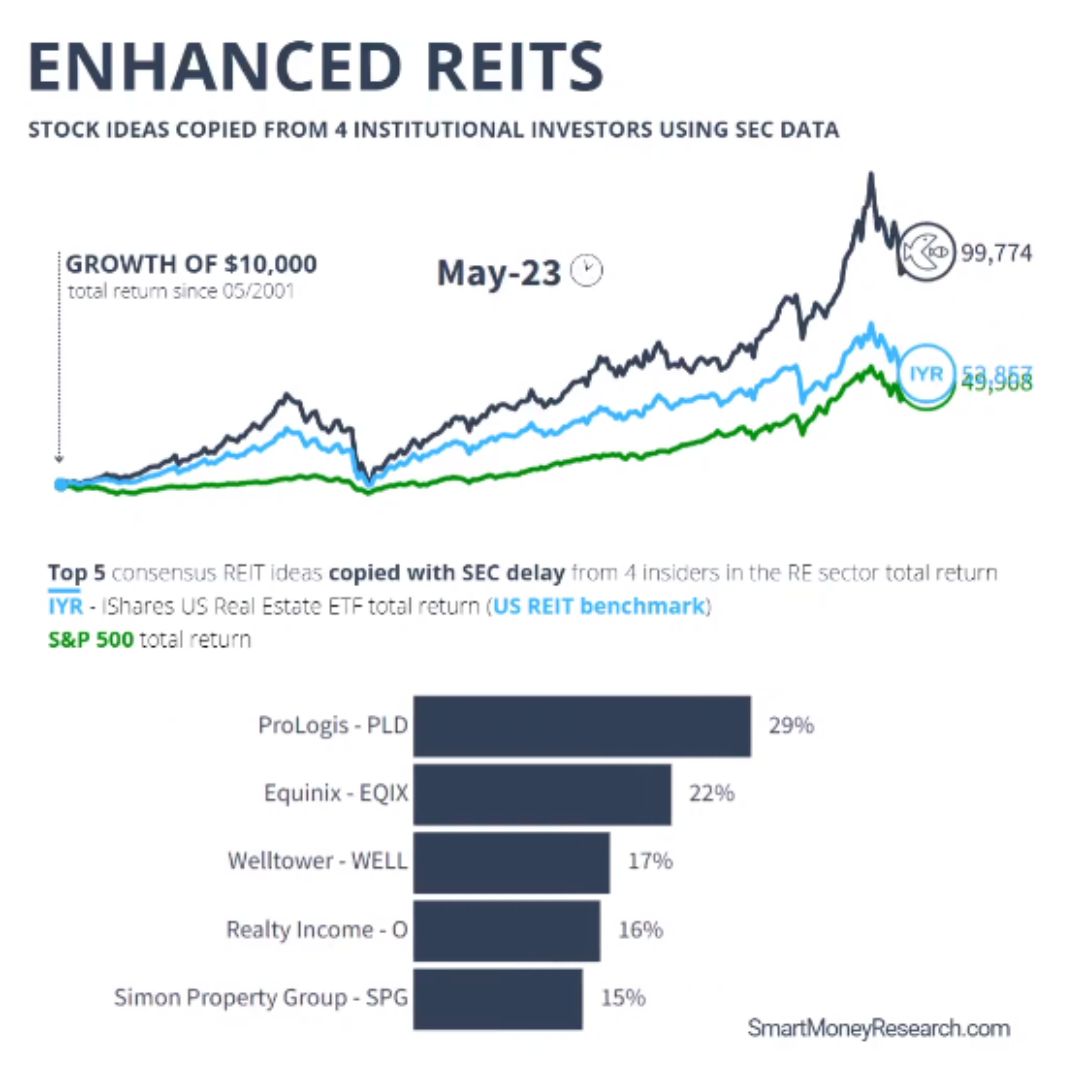

REITs

Enhanced REITs

998% x 499% (S&P500) x 539% (IYR)

since 05/2001

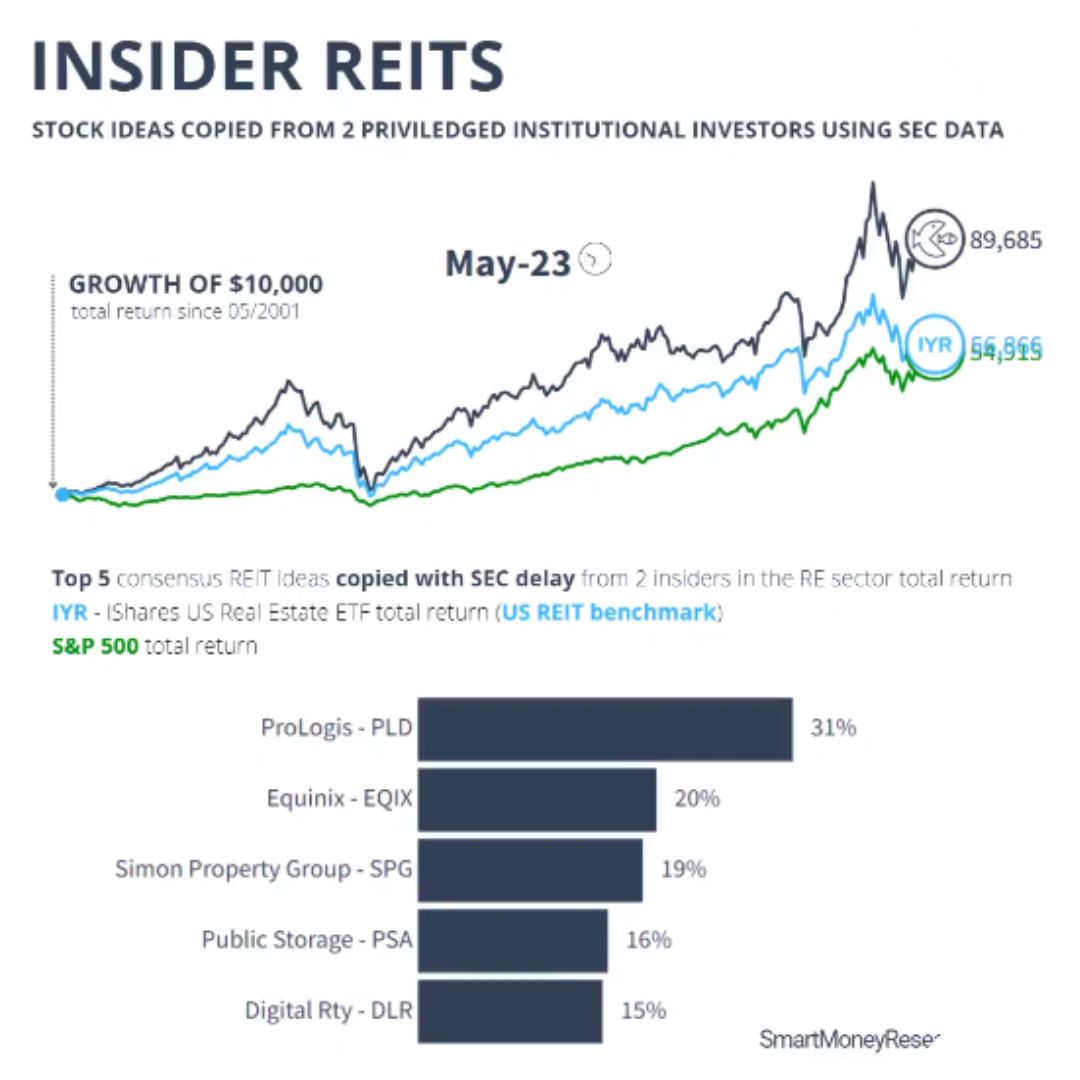

Insider REITs

897% x 549% (S&P500) x 569% (IYR)

since 05/2001

Trending News

[wp-rss-aggregator feeds=”google-noticias”]

The Curation Procedure

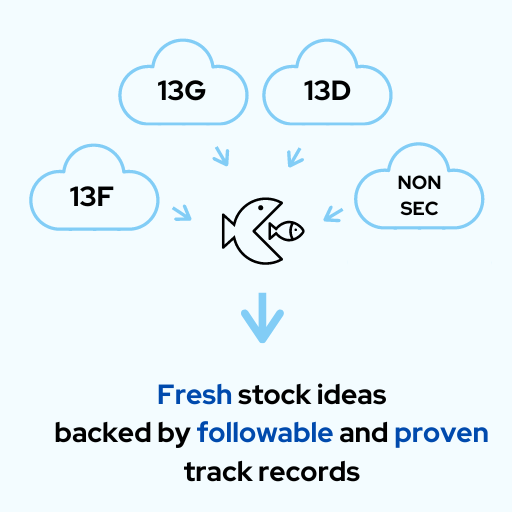

We diligently monitor the Securities and Exchange Commission’s mandatory filings (13F, 13G, 13D), as well as Investor Relations Channels and other relevant data sources. Our process involves:

- Identifying the most consistently profitable institutional investors within each stock/ETF/ADR sector or bias.

- Evaluating the performance of copied portfolios, even when factoring in the delayed SEC data. This typically indicates a medium to long-term stock selection strategy. We refer to such portfolios as “followable”.

- Seeking synergy within consensus among potential institutional investors.

- Pursuing more recent portfolio data than what is disclosed in the SEC’s 13F by cross-referencing various data sources.

Through this meticulous curation, we pinpoint groups of institutional investors (which may encompass investment advisers, hedge funds, banks, insurance companies, and the like) who:

- Adopt long-term strategic approaches, rendering any SEC data delays negligible.

- Consistently achieve impressive returns with minimal portfolio turnover.

- Possess a history of preemptively responding to market shifts.

- Attribute their profits to consistent success rather than mere fortuitous events (i.e., devoid of survivorship bias or mere ‘luck’).

Good investors don’t sell investment advice

NAVAL RAVIKANT

Successful angel investor in over 200 companies such as Uber and Twitter

The Essence of Smart Money

The term “Buy Side” is synonymous with institutional investors, including entities like hedge funds, investment advisers, banks, and insurance companies. The crème de la crème of the buy side—often referred to as the Smart Money—is driven by the urge to outperform the market at any given opportunity, leveraging non-public information.

Such exclusive information encompasses:

- Seats on Boards of Directors with privileged access to corporations.

- Direct and exclusive communication with directors.

- In-depth associations with private firms operating in sectors parallel to publicly-traded entities, obtaining invaluable insights on industry trajectories, pricing dynamics, and competitive terrains otherwise elusive to the public.

- The Mosaic Theory: Indirectly sourced data from company suppliers and clients, covert investigations, vigilant market oversight, and research. For instance, stationing an individual at a factory’s entrance to monitor vehicular activity, thereby inferring a company’s performance prior to the release of fiscal reports, or querying raw material suppliers about the flux in order placements.

It’s essential to differentiate that the Smart Money doesn’t pertain to the majority of hedge funds that marginally surpass indices. It represents a select echelon of institutional investors who prefer discretion, steering clear of the public’s immediate radar.

Conversely, the “Sell Side” predominantly caters to novice retail investors.

- Gurus and analysts sugarcoat banalities

Is it logically sound to outpace the market utilizing universally acknowledged data? While gurus and analysts often embellish trivialities, the sell side predominantly analyzes public fiscal data, news, and graphs—generic information universally known and factored into current market prices. In essence:

- Public data and news are universally acknowledged and have already influenced market prices.

- Both technical and fundamental analysis methodologies, widely recognized and applied by the market, are already priced in.

- Sell-side analysts might occasionally have ulterior motives, promoting specific stocks or corporations due to potential conflicts of interest.

In Summary

While the sell side might keep clients engaged with universally acknowledged data, the Smart Money (a niche segment of the buy side) aims to exceed market benchmarks without reservation, harnessing exclusive intelligence and strategies transcending conventional wisdom.

Emulate investment strategies from the genuine Smart Money and reflect their commendable performance. Note: Performance of replicated portfolios might surpass the original due to fee exemptions and a concentrated stock focus.

Ok, but why SMART MONEY?

-

Algorithms for Portfolio Selection: Smart Money Research leverages advanced algorithms to provide insights for an optimal portfolio selection. This means you can trust in a data-driven approach to maximize your investment strategy.

-

Based on Consensus of Top Investors: Unlike many other platforms, Smart Money Research integrates the collective wisdom of top investors. By harnessing the power of the consensus, they provide recommendations that have a backing from the industry’s best.

-

No Human Analysts: The platform is free from human biases as it does not rely on human analysts. With a pure focus on data, it ensures a level of objectivity in its analyses and recommendations.

-

Automatic Update for Profitable Portfolio: Stay always a step ahead with Smart Money Research’s automatic updates. The platform is designed to adapt and evolve, ensuring your portfolio remains optimized for profitability.

-

Price Point Advantage: Starting at just $8 per month, Smart Money Research offers a competitive pricing model, making advanced investment insights accessible to a wider range of investors.

When it comes to optimizing your investment strategy, Smart Money Research offers a suite of unique features tailored to provide advanced, data-driven insights.

| Features | Smart Money Research | The Fodley Mool | Seeking Beta | Zocks | Stack Raver | Nightstar |

|---|---|---|---|---|---|---|

| Algorithms for Portfolio Selection | ✓ | ✓ | ||||

| Based on Consensus of Top Investors | ✓ | ✓ | ||||

| No Human Analysts | ✓ | |||||

| Automatic Update for Profitable Portfolio | ✓ | |||||

| Long-term Investment Focus | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Thematic Portfolios | ✓ | ✓ | ✓ | ✓ | ||

| Detailed Historical Analyses | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Price (Starting from) | $8/mo | $99/yr | $199/yr | $249/yr | $8/mo | $35/mo |

Replicate stock ideas from the true Smart Money and mirror their performance¹1 – the performance of copied portfolios may be higher than theirs, due to the removal of fees and concentration on fewer stocks.

Already have an account? Sign in here

FAQ

Are the recommended portfolios subject to the same delay as data provided by the SEC?

Typically, they are, but there can be exceptions.

Forms 13D and 13G from the Securities and Exchange Commission (SEC) can provide valuable information about stock ownership in SEC-registered companies. Hedge funds with stock ownership between 5% and 20% can choose to file either Form 13D or Form 13G, depending on their intentions regarding the company.

Form 13D is required of anyone or group that acquires a stock ownership that reaches or exceeds 5% of the outstanding shares of an SEC-registered company. Form 13G is required of anyone or group that acquires between 5% and 20% of the outstanding shares of an SEC-registered company and has no intention of influencing control of the company.

Both forms provide valuable information about the size and nature of the stock ownership, as well as the owner’s intentions regarding the company. This information can be used to update hedge fund portfolios.

Why is Smart Money Research better than using the SEC website directly?

At Smart Money Research, we do the hard work for you by carefully handpicking the most appropriate hedge funds to follow. Our in-depth research allows us to identify expert managers in each investment area, while eliminating those with frequently changing positions or a history of closing underperforming funds (survivorship bias). Finally, we also seek synergy between the different chosen funds, where the successes of various managers add up and the mistakes cancel each other out. Thus we can deliver stock portfolios with great added value to our clients, which are not available in simple consultations to the raw SEC data.

Where can I find monthly performance and historical records of recommended portfolios?

The videos available on SmartMoneyResearch.com dynamically display the complete recommendation history and corresponding performance. Moreover, users can explore in-depth all the stocks mentioned in each new quarter by browsing the website.

What is the minimum investment amount required?

There is no minimum investment requirement, as investors can purchase any number of shares for the recommended stocks.

Why shouldn’t I invest directly in the funds?

There are several potential drawbacks of investing directly in hedge funds, including:

- High investment minimums: Hedge funds often require a significant amount of capital to invest, which can make them inaccessible to many individual investors. For instance, some hedge funds may require minimum investments of $1 million or higher, posing a significant barrier to entry for individuals seeking the potential benefits of hedge funds.

- Limited liquidity: Hedge funds frequently impose restrictions on investment redemptions, potentially making it challenging for investors to access their funds when needed.

- High fees: Hedge funds often charge high management fees, typically 2% of assets under management, and performance fees, typically 20% of any gains, which can eat into investors’ returns.

- Higher risk: Due to their complex and high-risk investment strategies, hedge funds can be riskier than traditional investment vehicles, with the potential for significant losses that can even exceed the original investment. The use of leverage and derivatives can amplify these risks and potentially result in the complete loss of assets.

What inspired the creation of Smart Money Research?

We realized that there is enormous value in the data that fund managers are required to provide to the SEC. Although the purpose of this disclosure is to provide greater transparency for transactions, the general public can greatly benefit from investment ideas curated by experts who heavily dedicate themselves to identifying the best opportunities. However, we know that the sole use of this information can lead to adverse outcomes, thus requiring data treatment work to choose which 13F forms are ideal to copy, and which filters are necessary to remove noise and potentially harmful information for investors.

Can I purchase stocks directly through the website?

At the moment, no. To invest, please use your preferred stockbroker.

Is the information provided by Smart Money Research subject to verification?

Yes, all information disclosed on our website undergoes rigorous verification before being made available to our users. This is important to ensure that our investment recommendations are based on accurate and reliable data, enhancing the security and efficacy of our clients’ investment decisions.

Yes. Everyone can benefit. From beginners to set up their first stock portfolio, to experienced investors who want to compare their strategies with smart money approaches.

Are the selected hedge funds susceptible to survivorship bias?

Survivorship bias is the tendency to focus on the investment performance of active funds that have survived until the present time, while ignoring the funds that have failed and disappeared from the market. This can lead to an overestimation of the performance of the surviving funds, as they may represent a selected group of successful funds that have managed to survive through skill or luck.

To avoid survivorship bias in the process of copying hedge fund portfolios, we can use a comprehensive dataset that includes both active and defunct funds. This will enable us to assess the historical performance of all funds, including those that have failed, and to avoid selecting only the successful funds.

In addition to using a comprehensive dataset that includes both active and defunct funds, there are additional techniques we can employ to avoid survivorship bias when copying hedge fund portfolios. For example, we can consider longer periods of time when evaluating fund performance, test the fund’s performance in multiple windows throughout this period, verify the fund’s resilience to crises, and use statistical techniques to identify cases of pure luck.

By using these techniques, we can gain a more complete and accurate picture of the historical performance of each fund, and avoid relying solely on the performance of a select group of successful funds that may have been subject to survivorship bias. This can help us to create a more robust and diversified portfolio that is better positioned to achieve our investment objectives.

Is Smart Money Research fully functional on smartphones?

Yes, the system is 100% usable with all its functionalities on mobile. As with many applications, the user experience on desktops may offer a slight advantage due to the ability to display more information simultaneously.